For me, the problem is a mismatch between different parties. Our customers have to piece together their process plants (e.g. alumina refineries, aluminium smelters) from a multitude of different technology vendors, often with the help of an EPCM / engineering company whose primary task is to execute the capital investment project on time and to budget, placing less emphasis on the operations afterwards. It’s therefore up to our customers to piece together their digital platforms and trying to integrate the data collected by a number of different equipment from almost as many providers. The end result I see is that the corporate programs are still often aimed at architecting the “overall solution”, piecing together the puzzle of which landscape is right for the given operation as a whole, while at the operational level, operations managers are still yearning for the practical applications that will help them meet their operational targets.

Then there are the big analytics companies of the world, who each promote their own “big data platforms”. These can be a great solution to customers who can’t afford to build their own platforms, but again they are not the experts in the process or the equipment. The solution is often to “measure everything” and then through advanced analytics, artificial intelligence, neural networks, try to find the patterns and deliver optimization results. In other words, they reverse engineer the actual chemical and physical processes that occur with in plants – and upfront it’s quite difficult to accurately forecast the results.

The technology vendors, Metso Outotec included, also have our own digitalization programs. For us the challenge is size and scale. In our value chain, for example, we compete with quite similar companies – mid sized companies (revenues 1-3 billion euros) for whom alumina / aluminium is only a part of the overall product portfolio. However, the basic philosophies of measurement, data collection and data analytics are common, which is why we work on two fronts. Firstly, developing a set of proprietary tools that work across industries that manage data analysis and measurement, trying to be as flexible as possible with how our customers want to use our products. Secondly, we need to tie our efforts to very practical applications. Many equipment vendors, unlike us, have also teamed up with analytics companies to develop the applications, but they are then tied to the given platform – which again might not be compatible with what the plant operator is installing.

What’s the solution in short-mid term?

We believe that while from a resource perspective Outotec may be smaller than the big analytics companies, we have are structurally advantaged by the fact that we understand the processes. We also have our own proprietary analytics software suitable for “digitizing” the process knowledge we have. This can directly be inputted with the equations that drive the process, and we also understand what benefits to look for.

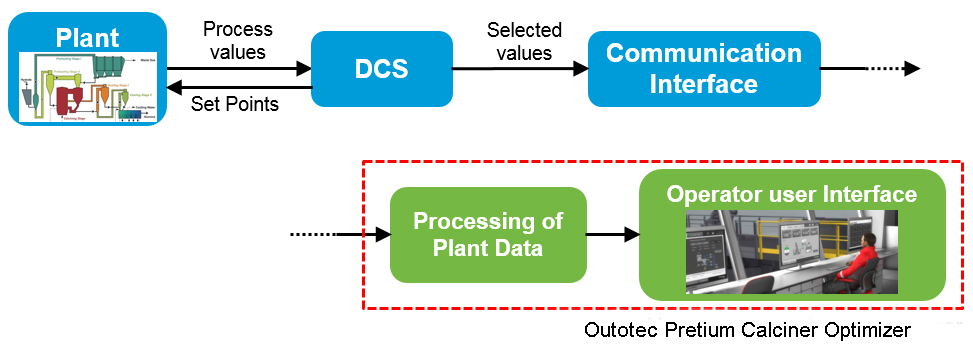

Metso Outotec’s digital strategy has been already for many years to work on two levels. Firstly, we need a common data management architecture that can work across our products and handle the collection and analysis of data. We made the decision as part of our digital strategy to make our platform independent of which platform our end customer is using. We called it the ACT, and have made it so that it can tie up to whatever our customers are using. Then, the equally important part has been to work on the practical applications of the data handling from day 1 – and now the results of this work are starting to show also in our more complex plant products, in addition to the equipment applications which we have developed already earlier.

In alumina, we got our first references last year for our Calciner Optimizer. This entails installing certain measurement systems into the calciner for real time analysis, and giving the operator real time advice on how to adjust operating parameters. The tool has engrained all the process knowledge we have in a codified package, without having to reverse engineer the processes. What to optimize depends on the calciner, but typical uses are saving on fuel, increasing throughput or optimizing maintenance. The results so far have been promising, with very high paybacks for the customer. Our model is based on a license fee; with annual benefits far exceeding the fee.